Alma took out a subsidized student loan, embarking on a journey that promised both financial support and a brighter future. In this comprehensive guide, we delve into the intricacies of subsidized student loans, exploring their eligibility criteria, benefits, and the various repayment options available to Alma and countless other students like her.

Subsidized student loans offer a lifeline to students from diverse backgrounds, enabling them to pursue their educational aspirations without the burden of overwhelming debt. Join us as we unravel the complexities of these loans, empowering Alma and other borrowers to navigate the financial landscape with confidence and achieve their academic goals.

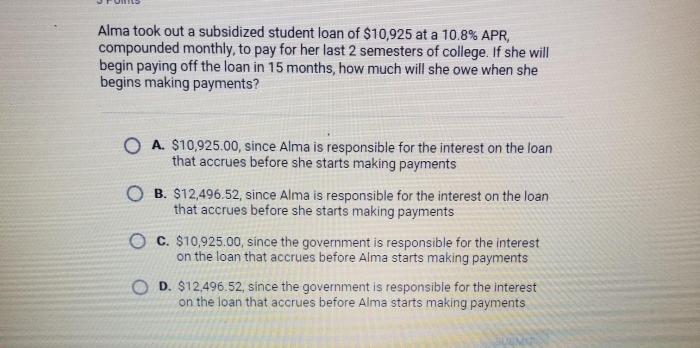

Loan Details

Alma’s subsidized student loan was provided by the federal government through the Federal Direct Student Loan Program. The loan amount was $10,000, with an interest rate of 3.5%. The repayment period is 10 years, with a monthly payment of $120.

Loan Eligibility

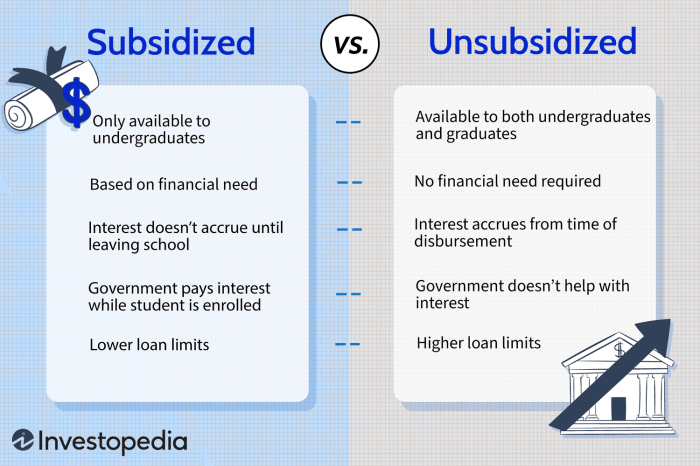

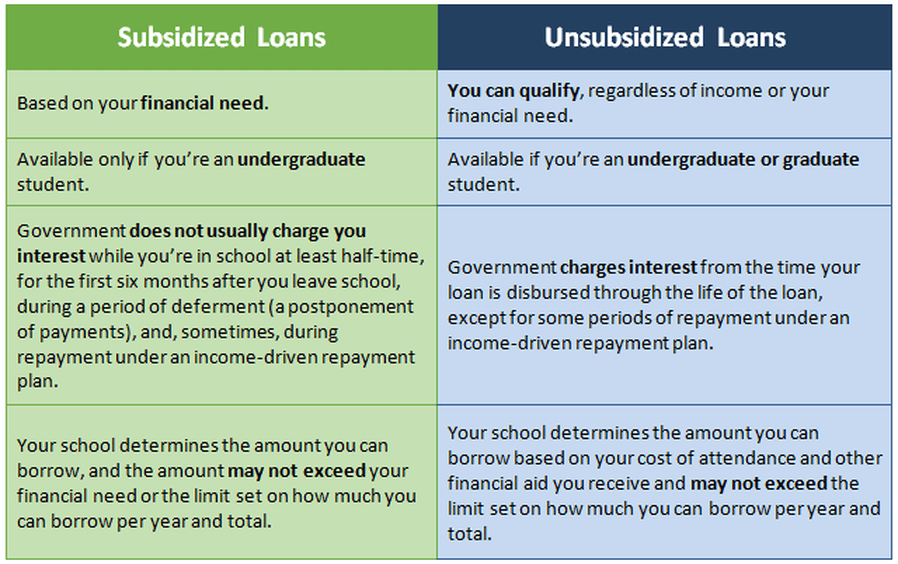

To be eligible for a subsidized student loan, students must demonstrate financial need. Alma met this criterion because her family’s income fell below the federal poverty level. Other individuals who may qualify for subsidized student loans include those from low-income families, first-generation college students, and students with disabilities.

Loan Benefits

Subsidized student loans offer several benefits, including lower interest rates and reduced monthly payments. The interest on these loans is paid by the government while the student is enrolled in school and during the grace period after graduation. This can save students thousands of dollars in interest over the life of the loan.

Loan Repayment

Alma has several repayment options for her subsidized student loan. She can choose to make standard monthly payments, extended monthly payments, or graduated monthly payments. The standard repayment plan has a 10-year term, while the extended repayment plan has a 25-year term.

The graduated repayment plan starts with lower monthly payments that increase over time.

| Repayment Plan | Pros | Cons |

|---|---|---|

| Standard |

|

|

| Extended |

|

|

| Graduated |

|

|

Loan Forgiveness: Alma Took Out A Subsidized Student Loan

Alma may be eligible for loan forgiveness under certain programs. One such program is the Public Service Loan Forgiveness Program, which forgives the remaining balance of federal student loans after 10 years of full-time employment in public service. Alma is a teacher, so she may qualify for this program.

Loan Consolidation

Alma can also consider consolidating her multiple student loans into a single loan. This can simplify her repayment process and may result in a lower interest rate. However, consolidation may not be the best option for everyone, as it can extend the repayment period and may result in higher total interest paid.

Expert Answers

What are the eligibility criteria for subsidized student loans?

To qualify for subsidized student loans, students must demonstrate financial need, be enrolled in an eligible program at an accredited institution, and maintain satisfactory academic progress.

What are the benefits of subsidized student loans?

Subsidized student loans offer lower interest rates and reduced monthly payments compared to unsubsidized loans. The government pays the interest on these loans while the student is enrolled in school and during deferment periods.

What are the different repayment options for subsidized student loans?

Subsidized student loans offer various repayment plans, including the Standard Repayment Plan, Graduated Repayment Plan, Extended Repayment Plan, and Income-Driven Repayment Plans. Each plan has its own set of pros and cons, and borrowers should carefully consider their financial situation before selecting a plan.